Friday, January 27th, 2017 and is filed under Economy, General, Housing Affordability, Housing Market, Housing Starts

2017 Housing Market Outlook: Single-Family Homes

Look for millennials to start entering the market, and the economy to continue its moderate growth.

The National Association of Realtors (NAR) noted that 2016 was a mixed bag. On the positive side, job creation, low mortgage rates and the expanding economy strengthened interest in home ownership. On the negative side, low supply and high demand pushed prices, meaning some buyers were priced out of the market.

The NAR forecast in 2017 indicates housing starts will continue adding more product to the market, meaning the cost of homes should moderate. But with the Federal Reserve pushing interest rates, the cost of borrowing money will increase. More millennials will enter the market, with NAR chief economist Lawrence Yun noting the importance of enough existing supply at entry-level prices to entice this age group.

Texas: Different Tales for Different Metros

Texas: Different Tales for Different Metros

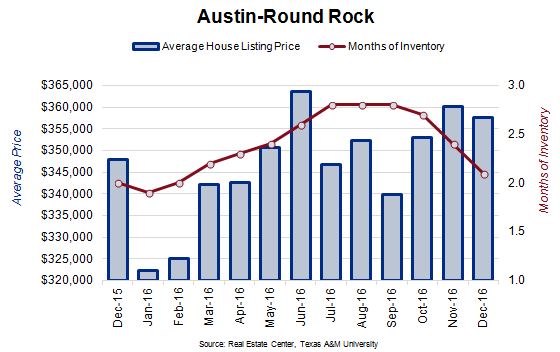

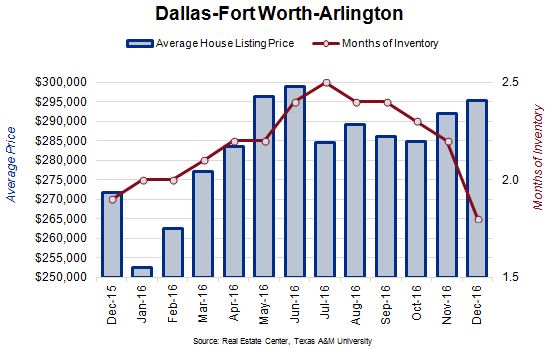

Texas single-family housing also proved to be a mixed bag in 2016, with more of the same likely to take place in 2017. North Texas, with its seemingly continual job-creation machine, experienced a steady acceleration of home prices, and dwindling months of inventory. As corporate headquarters begin bring employees into town, this trend will continue well into 2017. Austin, too, experienced robust price increases year-over-year, with 2.1 months of housing inventory remaining by the end of 2016, and much for the same reason as Dallas-Fort Worth – jobs. Still, higher house asking prices could push potential homeowners out of the market.

At the other end of the spectrum are Houston and San Antonio, with higher inventory and dropping prices.

One note about the inventory discussion, however. Most economists note that a housing market in equilibrium has approximately 4-6 months of housing inventory on hand. Houston (with 3.3 months) and San Antonio (with 3.0 months) continue showing that demand is outpacing housing supply and inventory. Many analysts believe that oil prices have bottomed out, which is good news for Houston. But those analysts also point out that it will take at least two years for Houston to recover from the slide.