Friday, July 1st, 2016 and is filed under Financing / Mortgage

Starting with the Great Recession and moving through its aftermath, the news each week brought new information about the increase in home foreclosures, short sales and transactions involving distressed assets. Yet these days, amid news of home sales, housing starts and even affordable housing have pushed foreclosure from the headlines. Or so it seems.

At the height of the financial crisis (2010), banks seized a record 1.2 million properties and served them with notices of default, auction or repossession[1]. Though it’s taken years for lenders and borrowers to work through foreclosures, the inventory is starting to dwindle. Black Knight Financial Services noted that delinquencies on home loans nationwide fell to 4.0%, the lowest rate since March 2007[2]

But we’re not out of the woods yet, apparently. According to CoreLogic, foreclosure rates are still higher than those of the late 1990s, when the market was “last normal”[3]. So while things have definitely improved since 2010, there is still some distressed housing inventory out there.

Texas: Two-Stepping Out of Distress

Because fewer new homes were built in Texas before the housing bubble, the bust itself was relatively mild during and after the recession.

This doesn’t mean that the Lone Star State was, or is, foreclosure-free, however. Approximately 26,000 Texas homes were some stage of foreclosure in April 2016, down considerably from the 33,000 reported the year before[4]. Foreclosure means that homes are bank-owned, in default, or on the auction block[5].

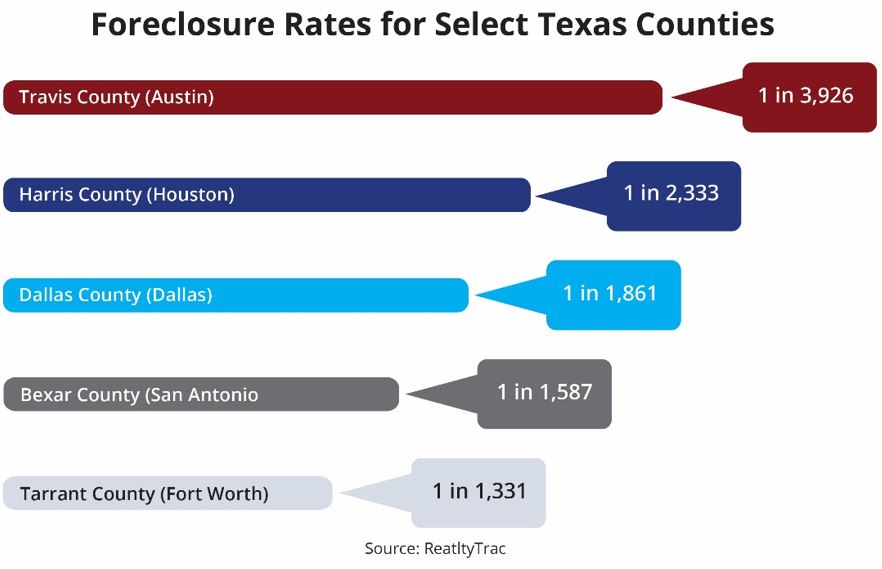

Travis County had the lowest number of foreclosures in May. Texas, as a whole, had 1 in 2,245 homes in some type of foreclosure[6].

The Bigger Picture

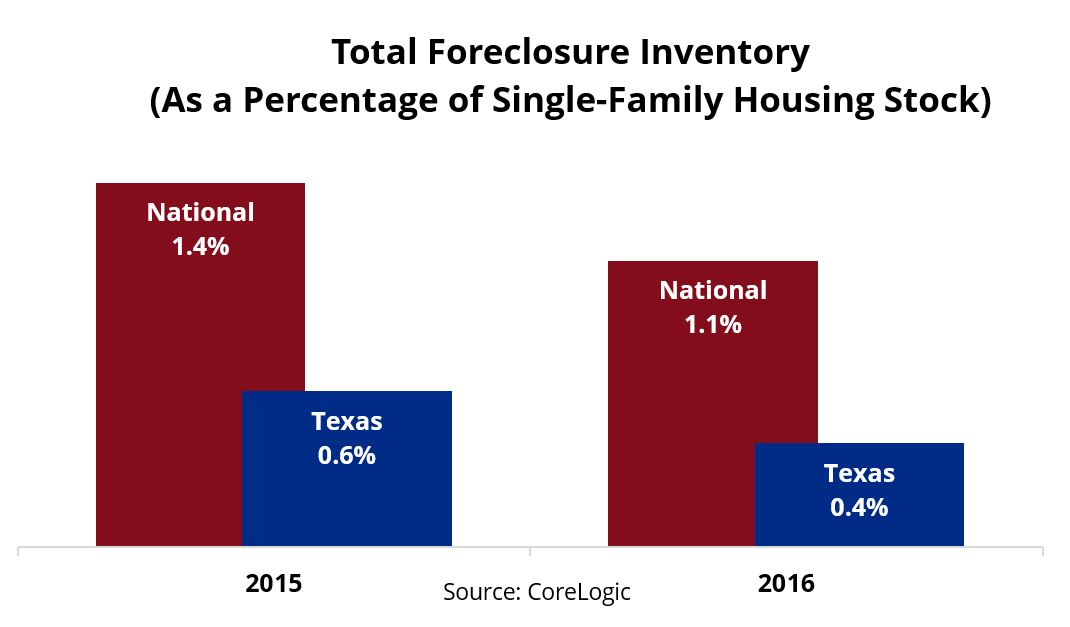

Even more heartening news is that the percentage of Texas homes in foreclosure is less than 1% of the entire single-housing stock throughout the state. Even better news is that the number continued dropping year over year, both on a state-wide and national basis.

There are several reasons for the drop in foreclosure rates. One is that banks, lending institutions and borrowers are slowly, but steadily, working their way through distressed inventory. Another reason is the increase in housing prices. Harvard University’s Joint Center for Housing Studies (JCHS), in its most recent “State of the Nation’s Housing – 2016” report pointed out that an increase in the nominal housing prices has helped reduce the number of homeowners who have been underwater on their mortgages. At the end of 2011, 12.1 million homeowners held mortgages that were worth more than the value of their homes. By the end of 2015, that number had fallen to 4.3 million.

Good News, But . . .

Foreclosures have definitely slowed. But the JCHS pointed out that at 670,000, the number is about twice the annual average before the downturn. And while the share of loans that are seriously delinquent has dropped considerably, it’s nearly double the average reported in the early 2000s. JCHS analysts said that continued foreclosures could exert downward pressure on home ownership rates during the next couple of years.

So overall, foreclosures have decreased since the height of the recession, which is good news. The not-so-good news is that distressed housing still seems to be exerting some pressure on recovery.

[1] Matt Scully (2016, April 25). “America is Finally Putting Home Foreclosure Crisis Behind it.” Bloomberg. Retrieved from http://www.bloomberg.com/news/articles/2016-04-25/america-is-finally-putting-the-home-foreclosure-crisis-behind-it.

[2] Ibid.

[3] Ibid.

[4] CoreLogic, “National Foreclosure Report (2016, April). Retrieved from http://www.corelogic.com/about-us/researchtrends/national-foreclosure-report.aspx#.V3-9rbgrI2w

[5] Ibid

[6] Ibid.