Tuesday, September 27th, 2016 and is filed under Construction, Economy, General, Housing Affordability, Housing Market, Housing Starts

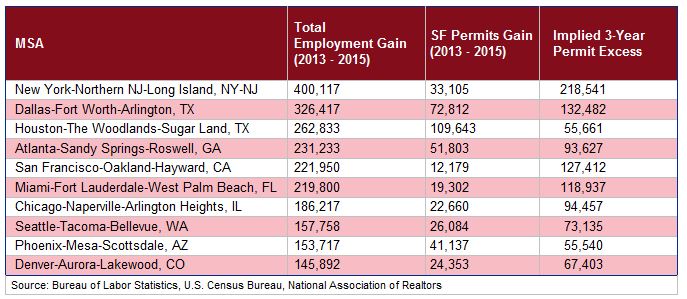

In a recent article, we reported that Dallas-Fort Worth area home sales skyrocketed in August, with prices not so far behind. We also noted that low inventory and growing demand were driving sales and cost increases.A recent report from the National Association of Realtors (NAR) put a metric to the scarce supply concept, pointing out that 80% of the 171 markets measured demonstrated “inadequate new construction” when it came to housing.1 Going even more deeply into the data provided, the NAR reported that the Dallas-Fort Worth-Arlington TX Metropolitan Statistical Area (MSA) has a shortfall of 132,482 permits necessary to meet the demand (with demand measured as employment figures).2

Interestingly, the Houston-The Woodlands-Sugar Land, TX MSA was also on that list, with a shortfall of 55,661. The two Texas metros were beat out only by the New York City metro, which had a shortfall of 218,541 houses.

Employment Tells the Tale

As seen in the chart above, employment plays a large role in calculating housing shortfalls. When people get jobs, they are more likely to form their own households. Those without jobs and money live with family or friends. During the current economic cycle, the U.S. has been fairly efficient in creating jobs and households. And, as can be expected, demand for housing has increased.

In coming to its housing shortfall conclusions, NAR measured the relationship between employment and permitted housing, which it dubbed the EP ratio. NAR pointed out that, from 1990-2002, the overall national EP was one single-family permit for every 1.6 new workers, making the long-term average (LTA) 1.6. The EP has been trending up since the end of the Great Recession. In 2014, the national EP was 3.7. The EP did drop to 3.4 in 2015. But looking at the 1.6 EP tells us there is a sizeable gap between housing and employment.

Long-Term Jobs in the Lone Star State

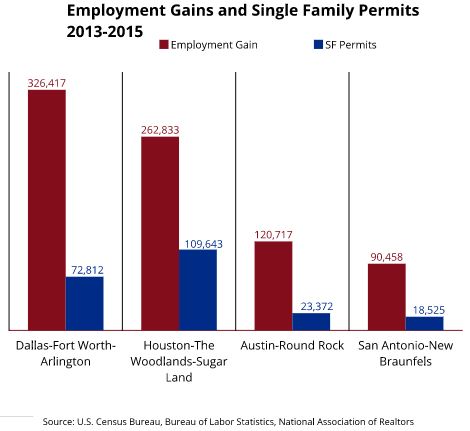

Examining the chart above, we can see that Texas is no slouch when it comes to job production. DFW has been on a steady upward employment trajectory. And while Houston struggled during much of 2015 due to shrinking oil prices, the metro still generated enough jobs during the three-year measurement period to have a shortfall of 55,661 houses. There are recessionary spots in the state – most notably, West Texas, because of oil. But overall, job gains have been positive.

Additionally, EPs in the state’s major metros have been well above the 1.6 LTA. The lowest was Houston, which was understandable, given the job cuts the area has undergone. Even so, an EP of 2.0 is still higher than the national average.

So what, exactly, is the “right” number of houses to build? Ted Wilson with housing analysis company Residential Strategies in Dallas noted that every two new jobs in a market creates demand for one single family home.3 Looking at the above graph comparing job creation and home building tells us it isn’t happening right now. Furthermore, given the constraints homebuilders keep bumping up against – rising costs, lack of skilled labor and permit delays – the housing gap will likely remain high in Texas’ metros for a while.

[1] “NAR Identifies Top 10 Markets in Dire Need of More Single-Family Housing Starts.” (2016, Sept. 19). National Association of Realtors. Retrieved from http://www.realtor.org/news-releases/2016/09/nar-identifies-top-10-markets-in-dire-need-of-more-single-family-housing-starts

[2] Fears, Ken (2016, Sept. 19). “Construction Gap Improves, but Remains Wide. National Association of Realtors. Retrieved from https://economistsoutlook.blogs.realtor.org/2016/09/19/construction-gap-improves-but-remains-wide/

[3] Brown, Steve (2016, Sept. 19). “Dallas Area Needs More than 132,000 Additional Home Starts, Realtors’ Report Finds.” Dallas Morning News. Retrieved from http://www.dallasnews.com/business/business/2016/09/19/dallas-area-needs-132000-additional-home-starts-realtors-report-finds