Monday, November 28th, 2016 and is filed under Economy, Financing / Mortgage, General, Housing Affordability, Housing Market, Housing Starts

PINPOINTING HOUSING TRENDS UNDER A TRUMP PRESIDENCY

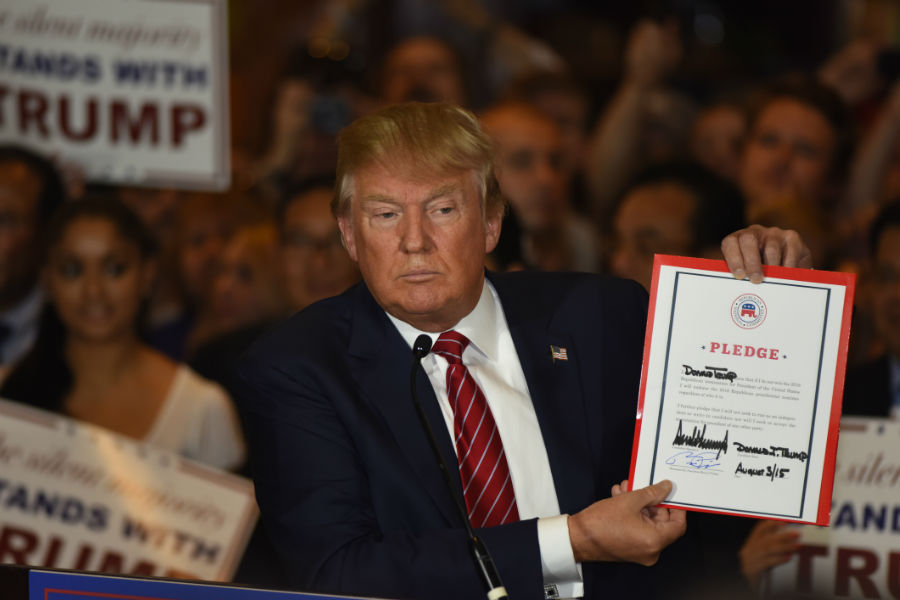

The Nov. 8 U.S. presidential election capped off a nasty, volatile and uncertain political cycle. In between the rhetoric, Donald Trump did mention a few policy ideas. Unfortunately, few of those ideas focused on residential housing. As the President-Elect’s administration heads toward the White House, there is a decided lack of clarity on the housing industry.

For now, the National Association of Realtors (NAR) indicated there won’t be much change1. At least, not in the short term. The NAR’s Chief Economist Jonathan Smoke said that the November elections took place during a slow time in the housing industry, meaning there won’t be much disruption in the seasonal pattern of home purchases or sales.

But down the road, Smoke and other industry experts forecast the following.

Repeal of Dodd-Frank

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 was passed in response to the Great Recession, with many of the provisions going into effect in 2012. Though the legislation provides oversight on banks and lending practices, the Republican Party doesn’t like the bill. The party believes that the regulations stymie local and regional banks, “the source of most home mortgages and small business loans.”2 Trump indicated he would repeal Dodd-Frank once in office. With fewer regulations in place, more capital could flow, especially to potential home buyers.

Looser Lending Standards

In a speech made to the National Association of Home Builders (NAHB) in August 2016, Trump indicated that 25% of the cost of a home is due to regulations3 . He pledged to cut the amount to 2%. With such a scenario, banks could loosen lending standards and lower credit scores required to qualify for mortgages, according to Matthew Pointon with Capital Economists4 .

Changes to Fannie and Freddie

The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corp. (Freddie Mac) are also in the crosshairs of the Republican Party5. The party’s platform once called for winding down both government service agencies, but that stance has shifted to reform, as opposed to dismantling. Given that these GSAs represent an important source of housing capital, any change to their operating models will mean a change in how capital is funneled to consumers.

Higher Housing Prices

We’ve written about affordable housing issues. Those issues could continue, and even escalate, according to experts such as Pointon6. Looser mortgage standards could mean increased demand for housing, in a market already experiencing high demand and scarce supply. In such a market, housing prices would increase, meaning “the next generation would find themselves struggling to qualify for sufficient mortgage finance,” Pointon said.

Financial Market Volatility

The global financial markets crashed in the early hours of Nov. 10, before recovering. In the days following the election, the U.S. stock markets were almost giddy. Fortune Magazine’s Editor-at-Large Shawn Tully believed that the reason for the market euphoria is because Trump has indicated pro-growth policies, even though the policies are muddled7. Still, financial market volatility and uncertainty prompts certain investors to flee to safety. Such safety could mean mortgage-backed securities8.

Immigration Concerns

One of the President-Elect’s promises was to build a wall between the U.S. and Mexico. It’s highly improbable that an actual wall will be built. However, it is likely that immigration policies could become more restrictive. This could mean problems for the housing industry. The NAR’s Smoke points out that immigration is necessary to housing construction.9 Housing supply is already behind demand, due to a lack of construction personnel, among other reasons. Stricter immigration policies could mean fewer workers available to build houses. Fewer workers means fewer houses – and higher housing costs.