Monday, November 28th, 2016 and is filed under Economy, General, Housing Affordability, Housing Market, Housing Starts

ARE FIRST-TIMERS RETURNING TO THE HOUSING MARKET?

There is plenty of pent-up demand in the housing market, according to industry experts. Sooner or later, these experts point out, those currently sitting on the fence will climb off the fence, especially those who are looking at houses for the first time. And when that happens . . . watch out!

The National Association of Realtors (NAR), in its September Home Shopper Surveys, finally quantified the issue with first-time home buyers1. Though the pool of buyers did shrink in September 2016 (which is typical), 52% of site visitors indicated they want to buy, and own, beginning seven months from now. In other words, the spring and summer of 2017. Spring and summer are typical for a higher volume of housing sales.

Even more interesting was that 52% of September 2016’s future buying pool identified as first-time buyers. In 2015, 33% of the future buying pool identified as first-time buyers.

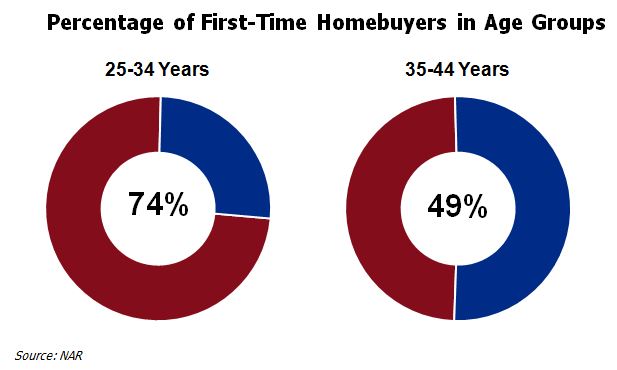

Who, exactly, are these first-time buyers? It should probably come as little surprise that 74% of those between the ages of 25-34 years are first timers, while 49% of those aged 35-44 are also in that category.

According to the NAR, the older millennials make up 33% of the active home shoppers. In the meantime, the older generation X/younger baby boomers account for approximately 17% of the active home shoppers. The prime motivation among the first-time older millennials and younger gen-Xers is that they’re tired of their current living situation.

According to the NAR, the older millennials make up 33% of the active home shoppers. In the meantime, the older generation X/younger baby boomers account for approximately 17% of the active home shoppers. The prime motivation among the first-time older millennials and younger gen-Xers is that they’re tired of their current living situation.

Furthermore, a larger percentage of first-time gen-Xers are out looking because of a pending marriage, or co-habitation with a partner. At the same time, a higher percentage of younger adults are actively looking for the first time because of large families, or plans to build large families.

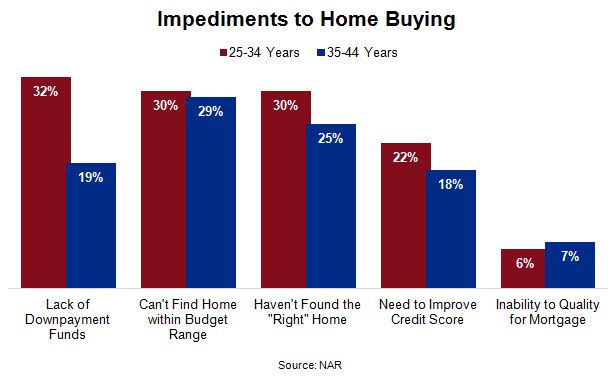

Finally, there are the impediments to home-buying among these age groups. Plenty has been written about millennials and gen-Xers stymied by debt and the mortgage qualification process. Debt is one roadblock, while saving for a down payment seems to be another. Other reasons why millennials and gen-Xers haven’t moved from shopper to bidder are because:

Finally, there are the impediments to home-buying among these age groups. Plenty has been written about millennials and gen-Xers stymied by debt and the mortgage qualification process. Debt is one roadblock, while saving for a down payment seems to be another. Other reasons why millennials and gen-Xers haven’t moved from shopper to bidder are because:

1) They can’t find houses within their budget range, and

2) They haven’t found the home that they truly want.

NAR analysts believe there will be more younger home shoppers starting next spring. But again, there might be problems in converting those shoppers into buyers for the following reasons.

NAR analysts believe there will be more younger home shoppers starting next spring. But again, there might be problems in converting those shoppers into buyers for the following reasons.