Tuesday, December 20th, 2016 and is filed under Construction, Economy, General, Housing Affordability, Housing Market

The Texas economy has been undergoing a mild recession, due to the oil price slump. The better news, however, is the Federal Reserve Bank of Dallas’ Texas Business-Cycle Index, which noted that Texas’ economy grew at a faster rate (4.5%) than its long-term average (3.9%) 1.

The even better news is that the Texas economy will continue expanding into 2017 2. A stronger economy means more job creation. Higher job creation means more people. And more people means a growth in housing demand.

Job Growth to Continue

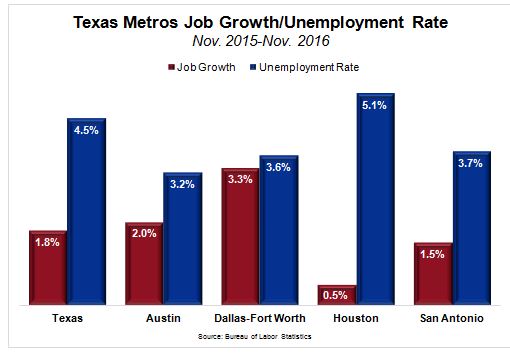

We’ve detailed the Dallas-Fort Worth 2016 job creation juggernaut in previous blogs. Additionally, an analysis of Bureau of Labor Statistics metrics shows the other major Texas metros haven’t been too shabby when it came to generating jobs, either. Even Houston, with its oil industry decline and bankruptcies, experienced positive job growth from November 2015-November 2016.

Though Houston’s year-over-year job gains (as seen in the state chart) were lower than the more than 100,000 jobs created in 2014, the economic picture is starting to brighten.

Though Houston’s year-over-year job gains (as seen in the state chart) were lower than the more than 100,000 jobs created in 2014, the economic picture is starting to brighten.

The Greater Houston Partnership pointed out, for example, that energy is starting to rebound, even though inventory drawdowns likely won’t begin until the second half of 2017 3. As such, optimism among those in the oil industry is guarded, and will remain so. However, manufacturing is starting to pick up, as have jobs in government and retail 4.

The downside in the otherwise rosy job picture is the lack of qualified employees versus positions in Austin and Dallas-Fort Worth. Dallas Fed economist Keith Phillips noted that a tight labor market means increased pressure on wages 5. While higher wages are good for workers, Phillips indicated that pricing pressures could increase if the higher wages don’t lead to increased productivity.

Housing Demand – Increasing, But Still Affordable

Another issue we’ve written about is high-priced single-family homes in Dallas – and the reason for those higher prices. Higher demand (jobs) coincided with less supply (labor shortages and restrictive zoning laws leading to fewer houses).

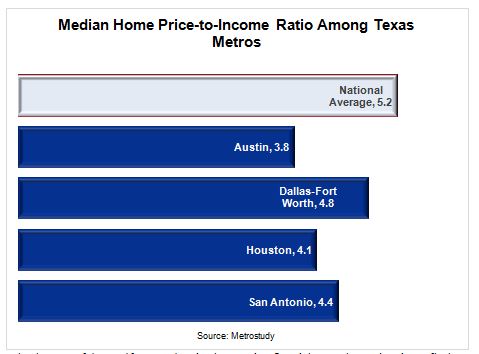

Yet, despite the higher prices, Metrostudy’s home price-to-income ratio among the major Texas metros – including Dallas-Fort Worth – remains below the national average. Basically, houses remain affordable to most who migrate to Texas.

Another booster of demand for a product is a lower price. Certainly, people aren’t going to flock to Texas simply to buy cheaper houses. But they will flock to Texas for jobs – with less-expensive houses on the market a plus. The increased demand, coupled with continued scarce supply, will mean higher prices.

Looking Forward

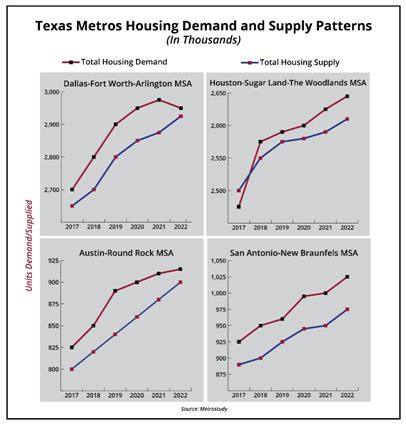

Metrostudy put together a five-year forecast for housing supply and demand in all four Texas metros. And, in all cases, demand is anticipated to outstrip supply through 2022.

This is already happening, with the Houston MSA a notable exception. However, Metrostudy anticipated that, by 2018, demand in and around the Bayou City will move ahead of supply, and remain there for the foreseeable future.

In the immediate future, plenty of housing demand will exist in DFW, Austin and San Antonio, especially as job gains continue increasing. Once again, the result will be higher housing prices.

CoreLogic takes this issue one step further. In its recent “U.S. Home Price Insights Report,” the research firm pointed out that, in October 2016 (the latest data), 109 housing markets in the U.S. were overvalued 6. Seventeen of those overvalued markets were in Texas – and included the major metros.

In short, as the Texas economy continues creating jobs, the demand for housing will remain strong. However, those interested in Lone Star State housing should be ready to take a little more out of their wallets to pay for those homes.