Tuesday, January 3rd, 2017 and is filed under Construction, Economy, Financing / Mortgage, General, Housing Affordability, Housing Market, Housing Starts

ARE HOME SALES SLOWING IN NORTH TEXAS? NOT LIKELY

Conventional wisdom states that home sales, on average, tend to wind down in November and December. The reasons are obvious: Colder weather can deter foot traffic, plus people, for the most part, aren’t interested in undergoing the stress of home-selling and home-buying during the holidays.

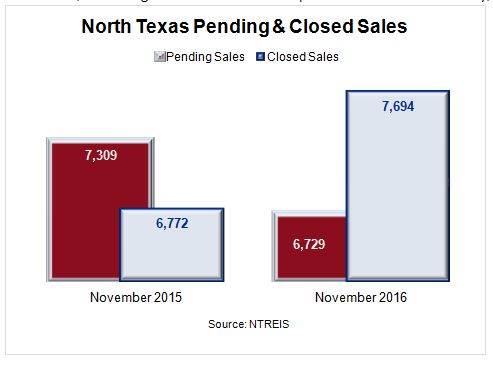

But North Texas economists were frankly baffled when November 2016 turned out to defy conventional wisdom. The reason was that North Texas home sales in November increased 26% from the previous year1 . The showy statistics certainly surprised James Gaines, chief economist for the Real Estate Center at Texas A&M University, who said “I don’t know if it was the election or the interest rates rising, but people have been buying a lot of houses – more than we expected, for sure.”2

What is actually going on? Why is a typically slow season resembling something one might see in spring or summer? There are a couple of reasons why the North Texas housing market continues to boom in the face of what should be a typical slowdown.

Higher Interest Rates

The number of sales closed in November increased by 13%, year over year, according to metrics from the North Texas Real Estate Information Systems3. And while the number of pending sales declined, more than 6,700 closings in North Texas will take place in December and January, which is still a respectable number.

The majority of the houses that closed in November were, more than likely, put under contract before Election Day, when it was assumed the status quo would reign. But even before Nov. 8, signs were rampant that mortgage costs would be increasing.

Those signs came to fruition in mid-December, when the Federal Reserve boosted key interest rates by a quarter point, to a range of 0.5%-0.75%. While a quarter-point isn’t much to get excited about, the Fed also indicated it could raise interest rates up to three times in 2017. To top that off, rates also increased in the wake of the Presidential Election.

Gaines noted that a lot of people likely got nervous about interest rates increasing. As a result, they “went ahead and locked in their rate, and brought sales forward, and got it done,” he remarked.1

Higher Housing Prices and Lower Inventory

The median price of a pre-owned house in the area increased by 15% in November, compared with a year earlier2 . Breaking it out in numbers, the median sales price of a home was $230,000, versus the $199,900 reported in November, 20153 .

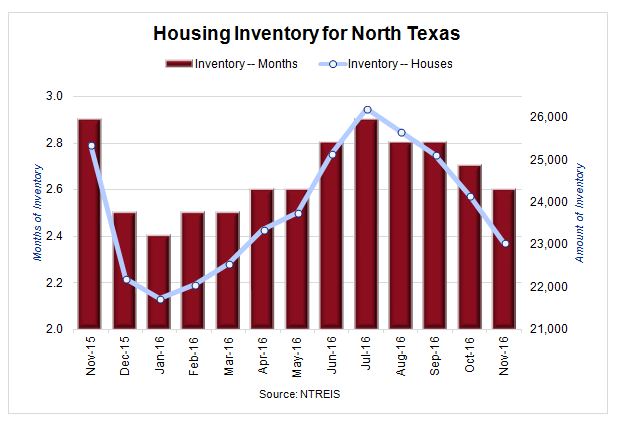

One of the main reasons for the price increases? One word: Inventory.