Thursday, March 9th, 2017 and is filed under Construction, Economy, General, Housing Affordability, Housing Market, Housing Starts

DALLAS HOUSING MARKET – EQUILIBRIUM? OR NOT?

A recent article in the “Dallas Business Journal” noted that a housing supplier distributor, Building Industry Partners, is betting that nationally, 17 million units of new housing will come to the market within the next decade1. Drilling down to the Dallas-Fort Worth metro, BIP’s bet looks to be a sure thing. In less than 10 years, the DFW housing market has gone from one of too much supply, to one in which demand is far outracing the stock available.

Defining Housing Equilibrium

Back in 2009, when the local (and national) housing market was on its way to the bottom, Texas A&M University’s chief economist James. P. Gaines attempted to define housing equilibrium, in other words, a housing market in which the number of units on the market matches the number of buyers for those units2.

Gaines wrote that “When the market is in balance, transactions occur at a reasonable and sustainable pace, and prices typically rise close to overall inflation . . .3” Otherwise, he indicated that housing researchers consider that a 6- to 6.5-month inventory generally represents a balanced housing market. This isn’t too far off what we’ve written in the past, that a housing market in equilibrium generally has 4-6 months of inventory.

It pays to keep in mind that this article, written in 2009, mentioned that months inventory in the Dallas area crept above the 6.5-month benchmark of equilibrium during 2008’s final three quarters. The median price of homes also fell; Gaines pointed out that this was due to stricter underwriting standards, “a generally negative buyer attitude,” and other market forces.

Reasonable Price Increases, Sustainable Transactions

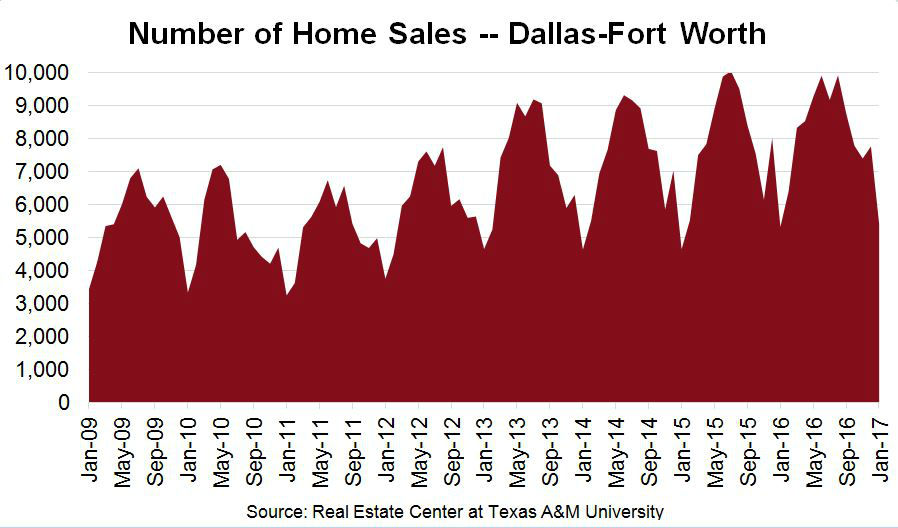

Now, let’s look at the current DFW housing market, and determine if, indeed, it is near equilibrium, according to Gaines’ definition. The graph below shows the number of home sales from January 2009 (when Gaines published his article) to January 2017, the most recent metrics available from the Real Estate Center at Texas A&M University.

The graph has peaks and valleys that are largely seasonal. But one interesting number of note, is that the number of sales in January 2017 (5,422), outpaces the number of sales in July and August of 2010 (4,936 and 5,172, respectively). And, if we’re comparing apples to apples, the number outpaces the previous January statistics, as well.

The graph has peaks and valleys that are largely seasonal. But one interesting number of note, is that the number of sales in January 2017 (5,422), outpaces the number of sales in July and August of 2010 (4,936 and 5,172, respectively). And, if we’re comparing apples to apples, the number outpaces the previous January statistics, as well.

One of Gaines’ definitions of a market in equilibrium concerns transactions occurring at a reasonable pace, equal to inflation. According to InflationData.com, the inflation rate for January 2017 was 2.5%4. If we look at the year-over-year sales growth from January 2016-January 2017, the percentage of sales increase seems well in line with inflation.

But looking at the same metrics, from the year before, January 2015’s inflation rate was 1.4%. The number of sales increases stood at 14.4%. And looking at the broader economic cycle trend, in four of the past eight years, DFW’s housing sales growth outpaced inflation. We’ve written before that sales have slowed, year over year, but more due to lack of inventory, rather than lack of demand. As of now, however, sales growth seems below inflation. It will be interesting to see what happens when the “selling season” of spring and summer 2017 bring. At that point, we’ll write a refresher article on this topic.

But looking at the same metrics, from the year before, January 2015’s inflation rate was 1.4%. The number of sales increases stood at 14.4%. And looking at the broader economic cycle trend, in four of the past eight years, DFW’s housing sales growth outpaced inflation. We’ve written before that sales have slowed, year over year, but more due to lack of inventory, rather than lack of demand. As of now, however, sales growth seems below inflation. It will be interesting to see what happens when the “selling season” of spring and summer 2017 bring. At that point, we’ll write a refresher article on this topic.

What about housing prices? We’ve written before that the region has been experiencing record housing prices. What’s interesting to see is exactly when those prices began picking up. Home median prices began increasing in mid-2013, and have continued climbing (taking into account seasonal dips), since that time. Whether the prices will dampen demand remains to be seen. So far, that hasn’t been the case.

What about housing prices? We’ve written before that the region has been experiencing record housing prices. What’s interesting to see is exactly when those prices began picking up. Home median prices began increasing in mid-2013, and have continued climbing (taking into account seasonal dips), since that time. Whether the prices will dampen demand remains to be seen. So far, that hasn’t been the case.

Enough Inventory for All?

Enough Inventory for All?

The inventory statistics is probably the most telling when it comes to the Dallas-Fort Worth housing market. We’ve written about that in the past, as well. Let’s look at inventory in the current economic cycle.

Remember Gaines’ description of housing equilibrium as between 6-6.5 months of inventory? The last time the Dallas-Fort Worth region had that type of inventory was in late 2011-early 2012. Since that time, inventory has dropped. In January 2017 – a winter month – housing inventory stood at 1.9 months. Though builders are delivering more units to the market, given job growth in the region, inventory is likely to stay low through the rest of 2017, and possibly into 2019.

Is DFW in Equilibrium?

Though you could make an argument for the fact that sales growth has NOT outpaced inflation for the past several years, Gaines reminds us that “equilibrium varies from marketplace to marketplace.” The Dallas-Fort Worth marketplace is experiencing an incredible housing demand, directly tied to the jobs it is generating. As of now, not enough housing units are on hand to satisfy the demand. So no, the market, at this point, is not in equilibrium. And, it seems, BIP might make good on its bet, at least in North Texas.