Tuesday, April 18th, 2017 and is filed under Construction, Economy, General, Housing Affordability, Housing Market, Housing Starts

THE QUIET SURPRISE: EAST HOUSTON’S ECONOMY

Mention the words “thriving Houston submarket,” and areas that might come to mind are the Energy Corridor on the far west side, the far north Houston towns of Spring and The Woodlands in Montgomery County, and even Fort Bend County, to the south. Probably the last place on the list that anyone would consider “thriving” is East Houston.

East Houston is best known as home to the Port of Houston and 93 million square feet of industrial, warehouse and distribution facilities, according to commercial real estate firm CBRE1 . However, CBRE’s recent report, “Development Capital Redefining East Houston,” shows a slowly changing impression of the submarket. Though huge swaths of land are attracting master-planned community developers to Houston’s west and far west areas, the areas directly east and southeast of downtown Houston have been attracting residents for quite some time. The CBRE analysts point out several reasons for east Houston’s slow rise in popularity.

1) Better access to the Port of Houston. The port is one of Houston’s main employers, meaning those who live east and who work there don’t have to deal with the rush hour traffic congestion on Interstates 10 or 45 or Beltway 8/Sam Houston Tollway. Additionally, the commute to the CBD is shorter from east and southeast Houston.

2) More activity. East Houston boasts a “healthy downstream petrochemical industry,” which, in turn, has spurred $60 billion in petrochemical projects. More projects mean more employment. More employment means more demand for rooftops, and retail.

3) New infrastructure development. With industrial demand playing a huge role in east Houston’s commercial real estate development, previously unimproved acreage is giving way to land that is, according to CBRE, “being rapidly developed and marketed with extensive infrastructure and structural investment.” Expansion is taking place among rail, barge and highway services throughout the east and southeast metro to accommodate both downstream petrochemical users and consumer product distribution.

Rooftops and Population Hikes

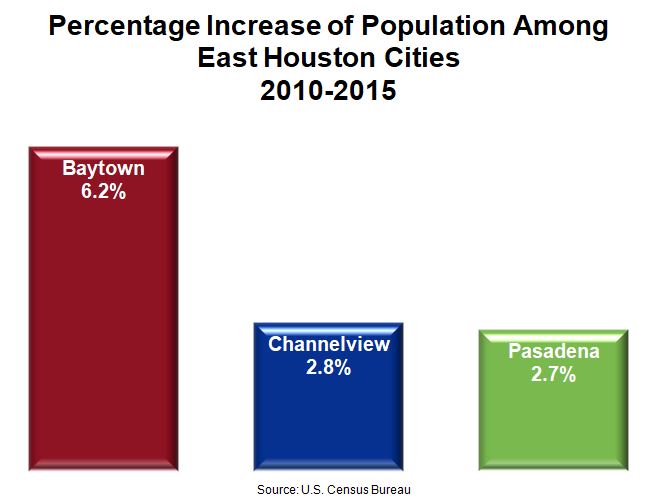

The CBRE report noted that population growth among 15 east and southeast Houston zip codes increased by 2.5% between 2010-2015. The chart below shows the percentage increase in population among three east and southeast Houston cities:

Baytown, TX, long known as a home to several petrochemical companies (as well as for its chemical-scented air), has been one of the fortunate recipients of developer interest and capital investment. Retailers have been taking advantage of growth in and around the city. The San Jacinto Mall on Interstate 10 is undergoing a massive redevelopment. Multifamily developers are also adding new product to the area. Furthermore, a new Kroger recently opened, while construction on an H-E-B-anchored shopping center is underway.

Examining East Houston

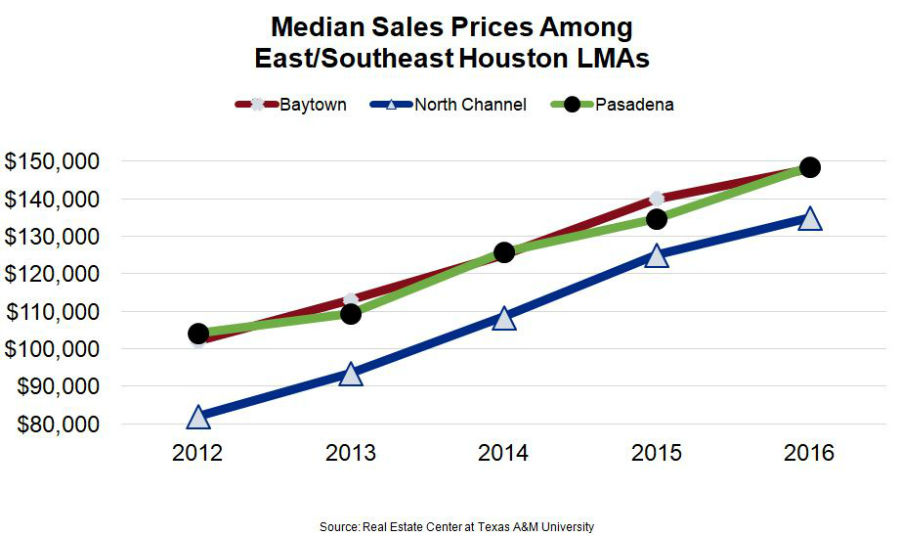

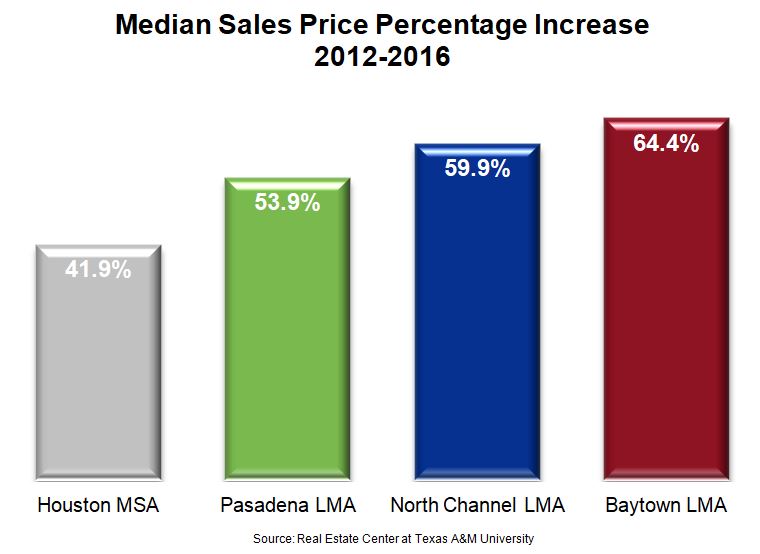

Those looking to Houston’s western and even northern submarkets for housing aren’t surprised at the lower inventory and higher prices. Local market areas (LMAs) in east and southeast Texas still have lower home prices. But median sales prices in the Baytown, North Channel and Pasadena, TX LMAs experienced large price increases within the past five years, according to data from the Real Estate Center at Texas A&M University.

As we’ve written in previous blogs, a sales price increase among housing means growing demand and scarce supply. Job creation, generally a sign of demand, has struggled throughout the Houston metro in the wake of falling oil prices. Yet, according to Rockspring capital’s Jim McAlister IV, “the downstream refining and petrochemical industries are experiencing the greatest construction boom in the history of the Texas and Louisiana Gulf Coast . . .” due, in part, to growing demand abroad for liquid natural gas (LNG) and similar products2 . Additionally, the Port of Houston has been propping up the Houston economy throughout the oil downturn, as global demand in plastics provided a boost to export activities in 20163 .

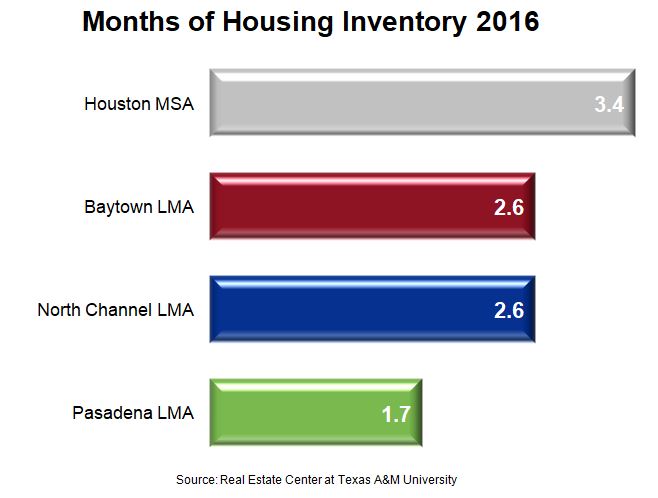

With strong demand drivers in east Houston, is there enough housing? The Houston MSA, as a whole, had 3.4 months of housing inventory in 2016, according to the Real Estate Center. The east/southeast LMAs had far less. Until construction catches up with demand, higher housing prices will continue to be the norm in these LMAs.

With strong demand drivers in east Houston, is there enough housing? The Houston MSA, as a whole, had 3.4 months of housing inventory in 2016, according to the Real Estate Center. The east/southeast LMAs had far less. Until construction catches up with demand, higher housing prices will continue to be the norm in these LMAs.

The Takeaway

The Takeaway

While economic attention has been focused on the west and north Houston submarkets, the east and southeast regions have been quietly undergoing their own job and population booms. The Port of Houston continues to generate both jobs and income, while petrochemical construction will eventually yield to industry employment, as well. CBRE is predicting that the east and southeast quadrants of the Houston metro will continue attracting capital dollars. Hopefully it will attract housing development, as well, before prices become too high.