Sunday, May 15th, 2016 and is filed under General

In previous blogs, we’ve mentioned difficulties young adults have in saving to buy homes. According to Fannie Mae’s National Housing Survey, half of young adults reported that scraping enough money together for down payments or closing costs ends up one of the largest obstacles in purchasing a home[1].

Parents will, many times, step in to help. Their help is welcome; the Federal Reserve Board reported, in its 2014 “Survey of Household Economics and Decision Making” that 18.1% of respondents of any age purchasing a home in the past four years said they made use of a loan or gift from family or friends for a down payment[2]. Additionally, the National Association of Realtors noted that, in 2015, 14% of all home buyers received some kind of gift to help with the down payment[3].

But do ALL financial gifts received from mom and dad automatically mean children will become home owners? According to Fannie Mae’s “The Role of Parental Financial Assistance in the Transition to Homeownership by Young Adults,” the answer is yes . . . but with some caveats[4].

In this recent, researchers examined two data sets concerning parental monetary transfers of $5,000 and above to adult children. These were the:

1) Panel Study of Income Dynamics (PSID) from 2012-2013.

2) Health Retirement Survey (HRS), based on data from 1998-2004.

Now, it’s important to remember that the money transfers weren’t specifically directed toward down payments. As such, the data demonstrated that, in some cases, wealth transfer didn’t always translate into home ownership.

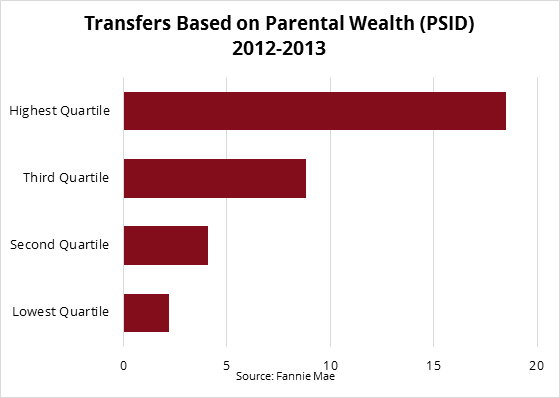

Mo’ Money

Unsurprisingly, wealthier parents were more likely to transfer money to their offspring, a fact borne out by the metrics below. But the researchers appreciated that even within the lower quartile, a percentage of parents were able to transfer funds to their children. In fact, even as such transfers decreased among the higher-end quartiles over time, they remained steady among the lowest quartile.

[1] Fannie Mae. 2014. “Fannie Mae National Housing Survey: What Younger Renters Want and the Financial Constraints They See.” Washington, DC (May). www.fanniemae.com/resources/file/research/housingsurvey/pdf/nhsmay2014presentation.pdf .

[2] Federal Reserve Board. (2015). Report on the Economic Well-Being of U.S. Households in 2014. Retrieved from http://www.federalreserve.gov/econresdata/2014-report-economic-well-being-us-households-201505.pdf.

[3] National Association of Realtors. (2015). Home Buyers and Sellers Generational Trends Report 2015. Home Buyer and Seller Generational Trends. Retrieved from http://www.realtor.org/reports/home-buyer-and-seller-generational-trends

[4] Myers, D., Painter, G., & Zissimopoulos, J. (2016). The Role of Parental Financial Assistance in the Transition to Homeownership by Young Adults. Fannie Mae. Retrieved from http://www.fanniemae.com/resources/file/research/housingsurvey/pdf/parental-assistance-wkg-paper.pdf.

But how much of these transferred funds went directly toward a home down payment?

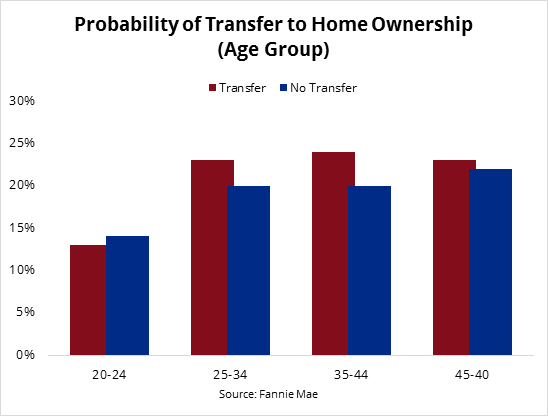

This is where it gets interesting. Some factors, such as age, also came into play. As seen in the chart below, younger populations didn’t transition into home ownership as quickly when receiving money from the parents. The researchers believed the young adults used the extra money for educational, rather than living, expenses.

But how much of these transferred funds went directly toward a home down payment?

This is where it gets interesting. Some factors, such as age, also came into play. As seen in the chart below, younger populations didn’t transition into home ownership as quickly when receiving money from the parents. The researchers believed the young adults used the extra money for educational, rather than living, expenses.

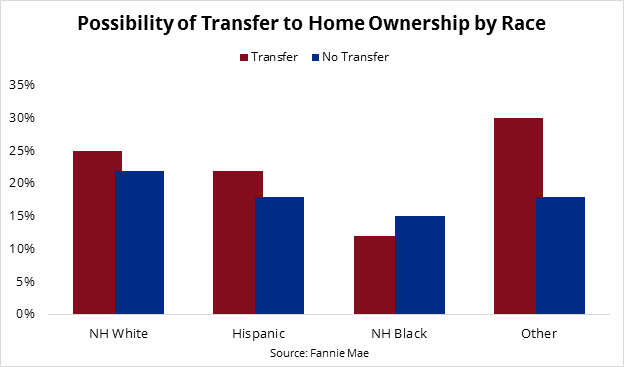

African Americans had the lowest home ownership transition across all races. This trend is something to consider, especially as the younger population becomes more diverse. As such, the role of parental assistance could weaken.

The Housewarming Gifts

The conclusion reached was that, for the most part, parental funding can accelerate the move toward home ownership, especially if mom and dad are also home owners. Yet surprisingly, children of parents with undergraduate college degrees or higher were less likely to use funds toward buying a home than the children of less-educated parents. The researchers believe that home ownership might be more important among parents with less education; they want their children to have better access to the “American Dream” of home ownership. The Fannie Mae researchers also suggest that geography might have a role. Children of higher-educated parents tend to live in larger cities, which have less affordable housing.