Housing, According to Ivy Zelman

Wednesday, June 15th, 2016 and is filed under Housing Market

You might or might not remember Ivy Zelman. She was a somewhat obscure housing analyst for Credit Suisse during the “oughts.” Obscure that is, until she downgraded the housing sector in 2006. Though ridiculed at the time (she received the nickname “Poison Ivy” for her downer forecasts during the insane days of the housing market), her downgrade proved to be prescient. These days, as head of Zelman & Associates, Zelman has become a major research and data housing source for the media and clients.

In a recent article published in Barron’s, Zelman outlined current and short-term future housing trends. Following are some of her observations.

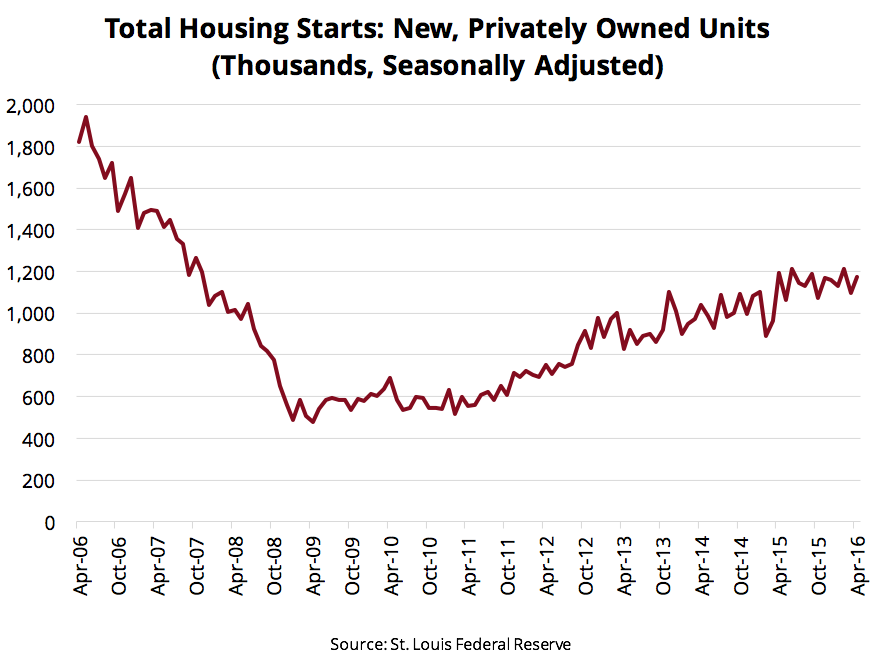

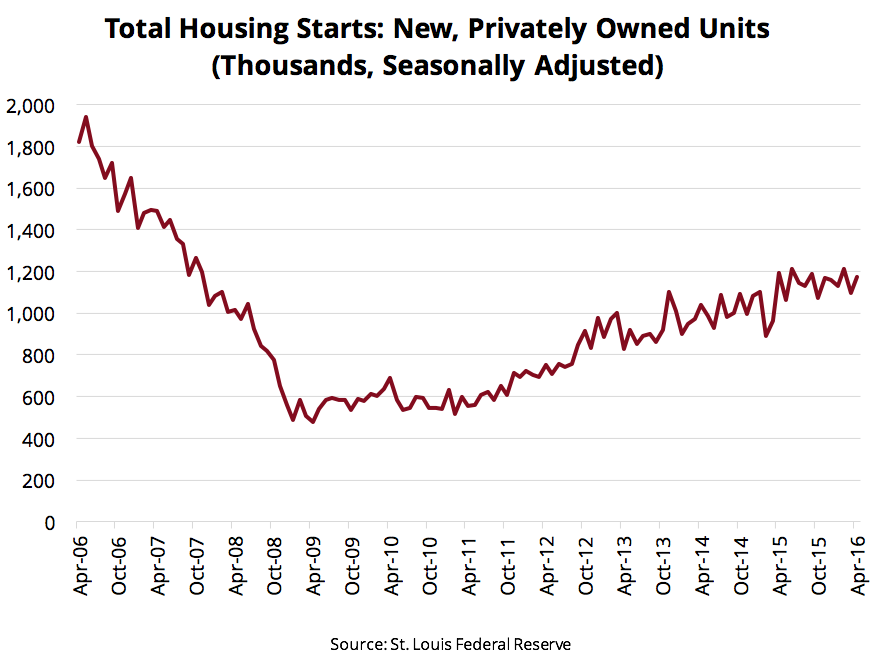

- The current housing recovery is four years old, assuming the bottom occurred in 2012. There are “multiple years ahead,” Zelman said, adding that the industry is 35% below the normal level of single-family starts.

- Housing demand is vastly outpacing supply available. Part of the reason is because builders haven’t been as quick to see growth. “The U.S. is at a 30-year low of inventory available for sale,” Zelman said; she is predicting double-digit housing starts through 2018.

Not Enough Housing: According to Ivy Zelman, developers have been slow to build single-family housing to meet demand. The starts are 35% below what’s considered “normal.”

- Renting is impacting supply. Between 10%-15% of new, single-family homes are being acquired by rental operators. The occupancy of such homes is 97%, with rent increases in the range of 4%-6%. Said Zelman: “It’s a pretty good business if you can manage the cost side.”

- Finding laborers to build homes is a challenge. So are impact and municipal impact fees; an issue mentioned in one of our previous blogs. In inland Southern California, developers can pay upwards of $50,000 to local municipalities in impact fees. Closer to home, Houston developers pay, on average, $2,000.

- Millennials are driving demand for new housing. Though the younger end of this age group continues to pay off debt and figure out how to save for down payments, older millennials are having families. For women over 25 years of age, the birth rate has been up 3.4% for the first time in six years. Among women 35 years and older, the rate was 5.3%. “By the time you get to that 40-year-old-and-over portion of your life, more than 70% of households live in single-family shelter,” Zelman remarked.