Monday, July 4th, 2016 and is filed under Financing / Mortgage

The homeownership rate remains low, especially in the face of easing credit standards and an improving economy. It’s been commonly acknowledged that several reasons for this trend include the struggle to save for down payments and lower credit scores (mainly due to student debt).

Another important reason could be general ignorance involved with actually applying and being approved for a mortgage.

To better understand if lack of knowledge might be a factor in the homeownership rate, the Federal National Mortgage Association (Fannie Mae) conducted an online study among 3,868 adults age 18 and over. (1) The survey focused on participants’ understanding of specific mortgage criteria, including down payments, credit scores and debt-to-income ratios. The sample included a high number of African-Americans, Hispanics and Asian-Americans, in an attempt to better study these subgroups.

The results were somewhat surprising in that approximately half of all survey participants were unable to provide answers to questions about down payments, credit scores and debt-to-income ratios. Furthermore, only 23% of the total sample were aware of 3% and 5% down-payment programs.

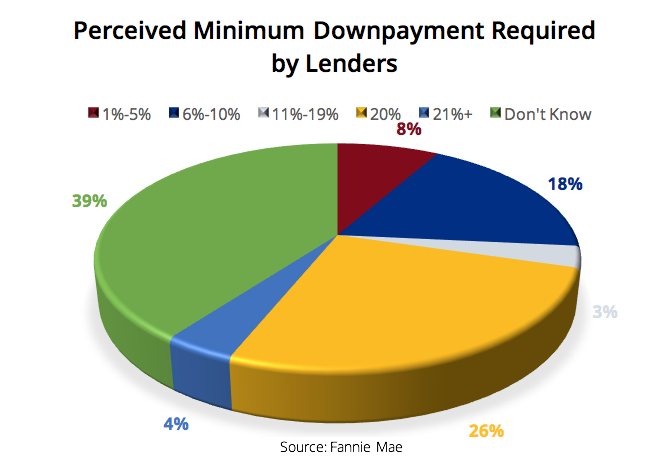

And when it came to perceptions of what lenders expected in terms of a down payment, a large part of the sample believed that 20% down was necessary to buy a house, while a whopping 39% of those surveyed didn’t know.

Other results noted that:

Fannie Mae suggested that additional educational efforts about underwriting factors might be helpful in mitigating the lack of knowledge about mortgage qualifications.

Other suggestions included:

Though other factors are certainly responsible for the sluggish home ownership rate, a better understanding of how to obtain a mortgage could help some potential homebuyers feel less intimidated about the process.

(1) Fannie Mae Economic & Strategic Research Group, 2015. What Do Consumers Know about the Mortgage Qualification Criteria?. [Online]

Available at: http://www.fanniemae.com/resources/file/research/housingsurvey/pdf/consumer-study-121015.pdf

[Accessed 4 March 2016].