Tuesday, September 13th, 2016 and is filed under Construction, Economy, Financing / Mortgage, General, Housing Affordability, Housing Market

Beginning in the early 2000s, some residential home builders began mass-producing larger houses. In some areas, developers found plenty of lots on which to build such houses. Nor was it uncommon for a developer to buy two or three smaller older houses, combine the lots, and put a mega-house in its place.

As the decade wore on, the number of these mass-produced homes, called “McMansions,” increased. Despite the negative press these houses attracted, demand increased. Low interest rates, combined with residential builders’ aggressive marketing meant that “the stage is set for the Jonses – and everybody else – to get their piece of the pie,” wrote Investopedia’s Lisa Smith in 2005[1].

Then came the housing crash, during which most residential housing development – from McMansions to multifamily – ground to a halt. These days, close to a decade after the fall, the housing market recovered nicely in most regions. But McMansions are, in many areas, housing non grata.

Fewer people are willing to pay the extra premium for the larger houses, and they aren’t holding their value very well, according to Trulia[2]. And while everything is bigger in Texas, Trulia’s metrics show the McMansion trend on the downside in the Lone Star State as well.

Defining the McMansion

Other than “big,” what, exactly, is a McMansion? Certainly, designers and architects are more than happy to tell people what a McMansion is not: visually balanced, in proportion, and sticking to one particular architectural style. Trulia also defined McMansions as:

1) Generally built between 2001-2007.

2) Approximately 1.5-2.5 times larger than a median-sized new homes in 2000; typically measuring from 3,000 square feet-5,000 square feet.

3) Mass produced, following similar cookie-cutter architectural styles.

4) Situated on very small acreage.

Falling McMansion Premiums

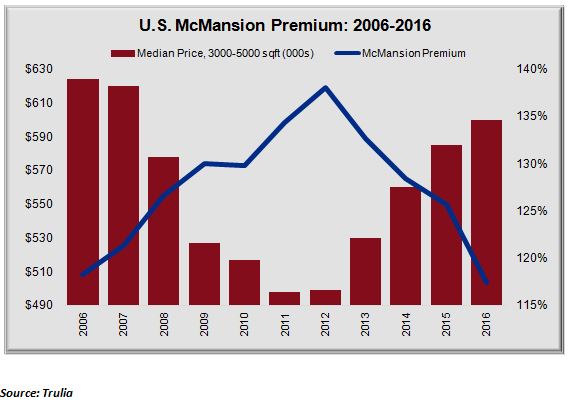

McMansion premiums – in other words, the extra money people are willing to pay to own one – have been falling off since 2012, well after the end of the Great Recession. Though the housing recovery began at this time, that positive energy didn’t flow over to the McMansions. Trulia points out that the home value premium of McMansions fell from 138% in 2012 to 117% in 2016.

McMansion Premiums Tanking in Texas

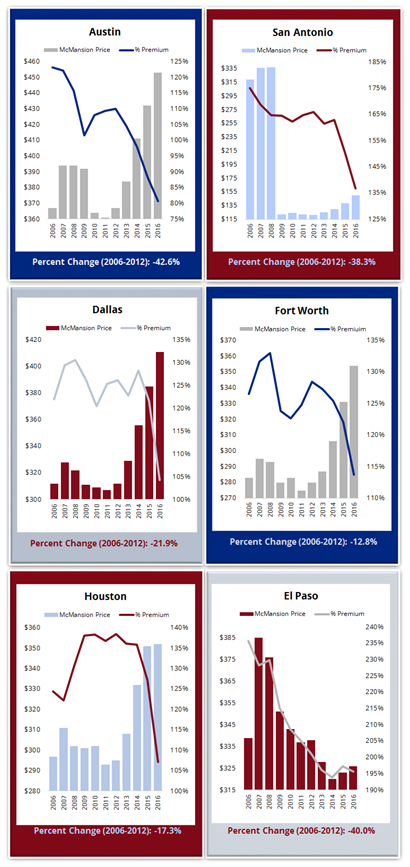

Though there aren’t specific statistics about how many of these larger homes went north throughout the Lone Star State, anyone living in and driving around, the metro triangle likely witnessed much of this housing being built during the 2000s. And, at the time these homes were built, plenty of folks were happy to pay for them.

While Texas weathered the housing crash better than other areas, the McMansion subsector (for lack of a better word), never really recovered. McMansion prices have increased – not surprisingly, as housing prices, overall, have shot up throughout the state. But McMansion premiums have steadily dropped.

One exception is Houston, an area in which it seems as though homebuyers paid the premiums, at least, until oil prices began their slide.

Meanwhile, in El Paso, energy also took a toll on the premiums. Additionally, factors such as violence spilling over from Mexico took its toll on El Paso’s economy, especially between 2010-2013.

Demographics = Little McMansion Demand

In addition to economics, demographics have also driven the McMansion premium drop. First-time millennial homebuyers can’t afford the houses. On the opposite end, downsizing baby boomers aren’t interested, either.

Trulia listed a couple of other reasons for the falling demand.

This doesn’t mean that the McMansion trend is dead and gone. In some regions, individuals are okay with paying higher premiums to own these houses. But the days in which McMansion developers could count on a supply of willing buyers are definitely long gone.

[1] Lisa Smith (2005). “McMansion: A Closer Look at the Big House Trend.” Investopedia. Retrieved from http://www.investopedia.com/articles/pf/07/mcmansion.asp.

[2] Ralph McLaughlin (2016, August 25). “Are McMansions Falling out of Favor?” Trulia. Retrieved from http://www.trulia.com/blog/trends/mcmansions/